HW:

Q1:請問各種避險策略與不避險,各個結果為何?你的避險策略?

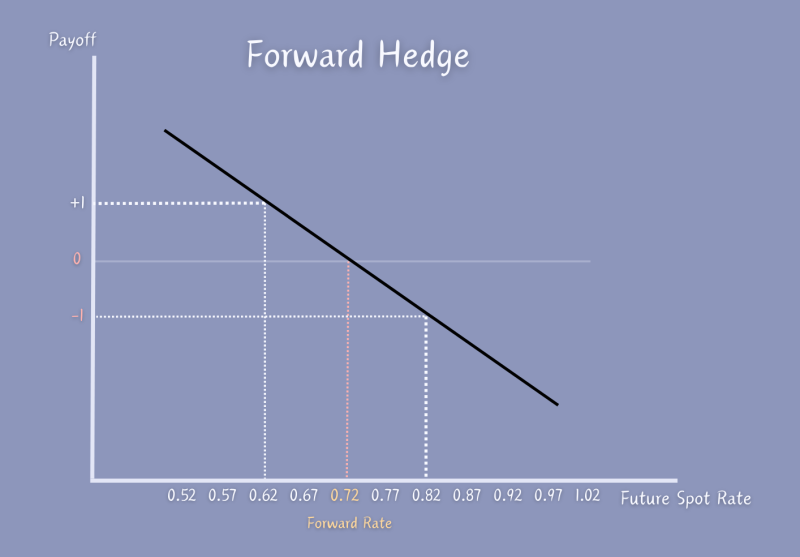

Forward Hedge:

SF200,000 * $0.72(sell→ask price) = $144,000

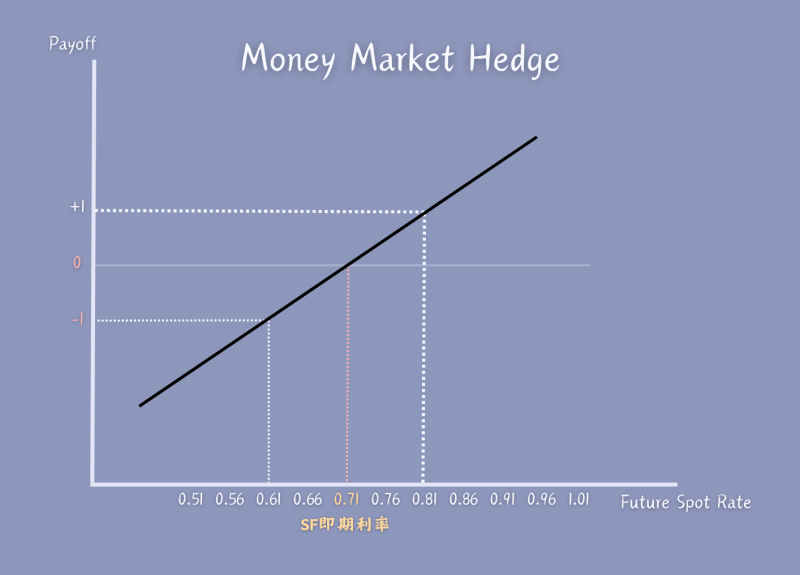

Money Market Hedge:

借出外幣→SF200,000 / (1+0.03) = SF194,174.76

外幣轉本幣→SF194,174.76 * $0.71 = $137,864.08

一年後收回的本利和→$137,864.08 * (1+0.02) = $140,621.36

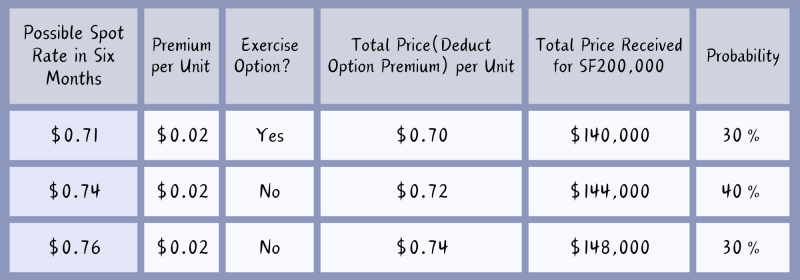

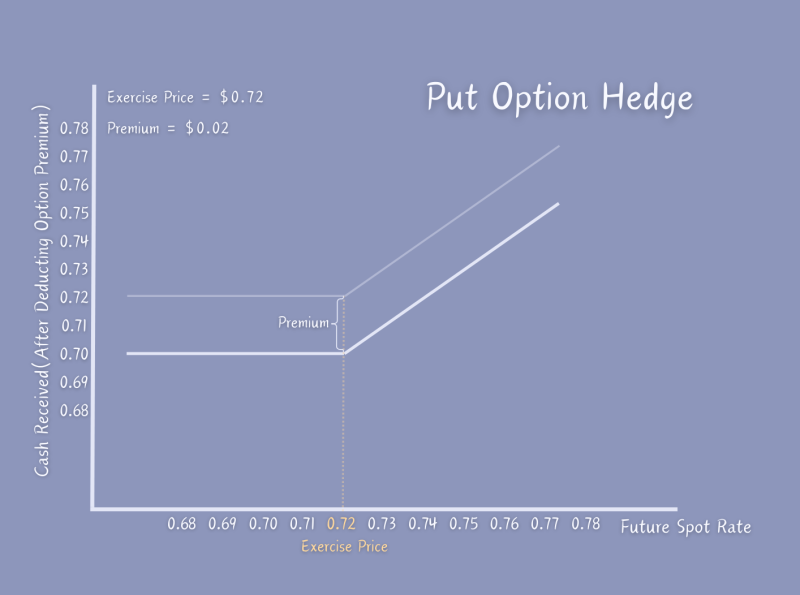

Call Option Hedge(期望值):

put履約價 = $0.72,價金 = $0.02

期望值 = $140,000*0.3+$144,000*0.4+$148,000*0.3 = $144,000

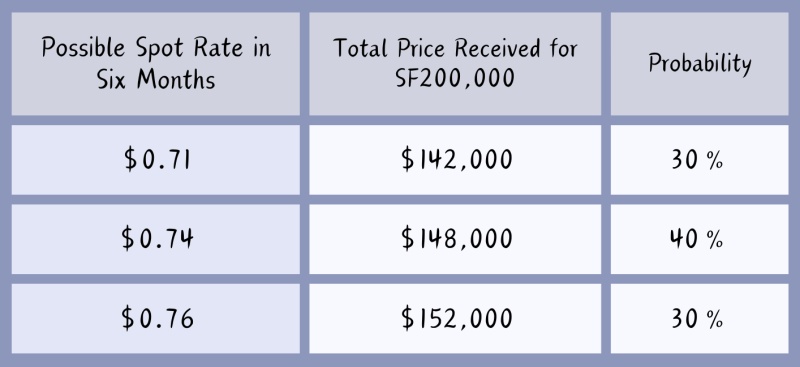

No Hedge (期望值):

期望值 = $142,000*0.3+$148,000*0.4+$152,000*0.3 = $147,000

Conclusion:

最佳策略為無避險策略

Q2:請劃出遠期契約、貨幣市場契約與選擇權契約的避險contingency graph。

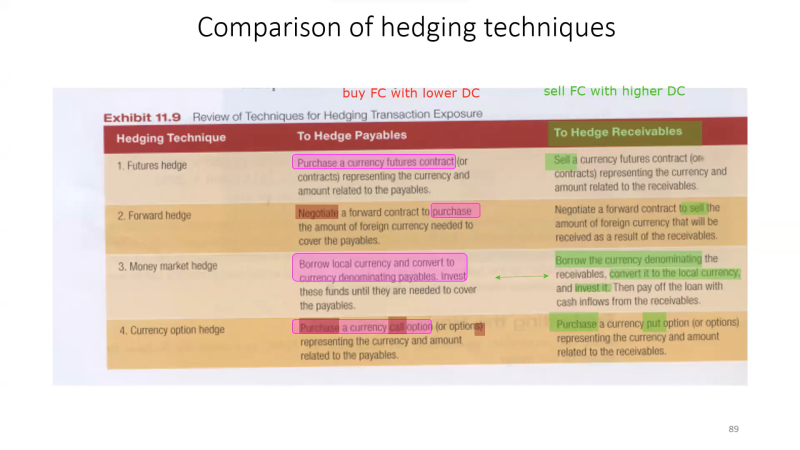

交易曝險的避險筆記

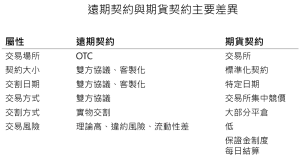

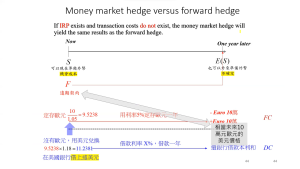

IFM_HW5Comparison of currency forward and futures contracts

CurrencyF&fContracts_Comparison

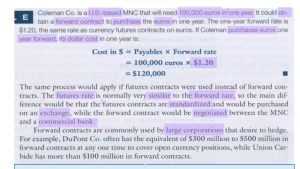

Forward Contract hedge example

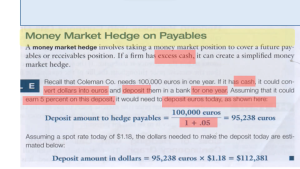

Money Market hedge example – with excess cash

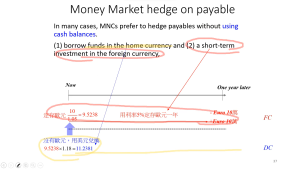

Money Market hedge example – without using cash balance

→一年後還銀行的借款本利和(美元)=一年後所需的10萬歐元

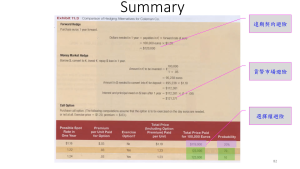

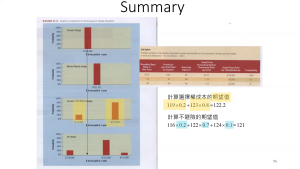

避險技術成本比較

Cost of:

- Forward:$120,000

- Money Market:$121,371

- Call Option(期望值):$119,000*0.2+$123,000*0.8 = $122,200

- No Hedge (期望值):$116,000*0.2+$122,000*0.7+$124,000*0.1 = $121,000

→最終選擇遠期契約來避險

**:第一次作業有修改後重新私訊老師了!

HW5