1. EXERCISE

Ans.

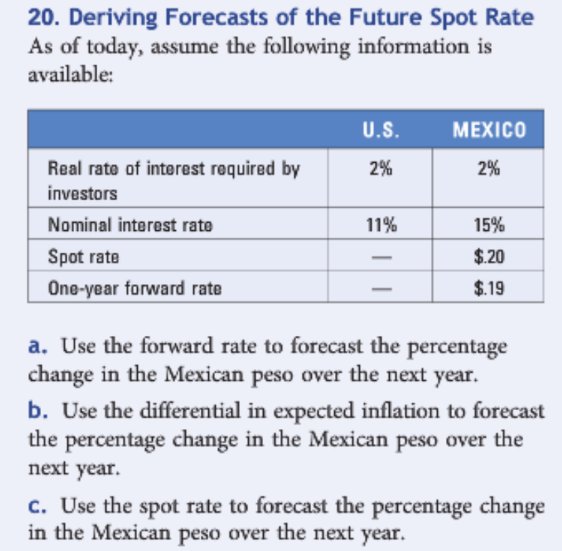

a. St-1 = $0.20, St = $0.19

Percentage change in the Mexican peso = ($0.19 – 0.20$)/$0.20 = -0.05 = -5%

b. Percentage change in the Mexican peso = 11% – 15% = -4% →DEPRECIATION

c. Percentage change in the Mexican peso = 0%

Ans.

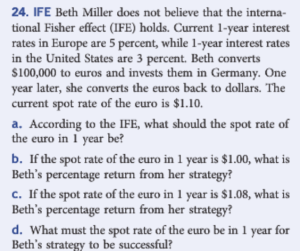

a. S = $1.10, id = 3%. if = 5%

IFE : [E(S) – S]/S = (id – if)/(1+if)

→[E(S) – $1.10]/$1.10 = (3% – 5%)/(1+5%) = -0.0190

E(S) = (-0.0190*$1.10) + $1.10 = $1.0791

b. income = ($100,000/1.1)*1.03*1 = $93,636.36

Percentage return = ($93,636.36 – $100,000)/$100,000 = -0.0636 = -6.36%

c. income = ($100,000/1.1)*1.03*1.08 = $101,127.27

Percentage return = ($101,127.27 – $100,000)/$100,000 = 0.0113 = 1.13%

d. Assume that the spot rate of the euro in one year is $x

income = ($100,000/1.1)*1.03*x = $93,636.36*x

Percentage return = ($93,636.36*x – $100,000)/$100,000 > 0

x > $100,000/$93,636.36 ≒ 1.07

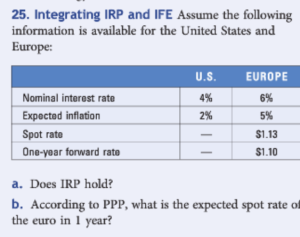

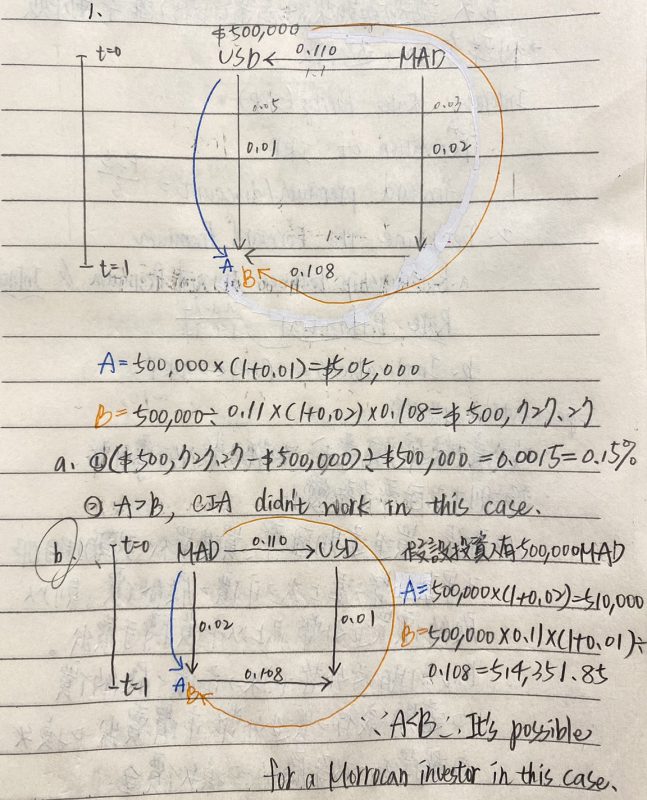

Ans.

a. Forward Premium/Discount = ($1.10 – $1.13)/$1.13 = -0.0265

Interest Rate Differential = (4% – 6%)/(1+6%) = -0.0189 ≠ -0.0265 → doesn’t hold

b. S = $1.13, E(id) = 2%, E(if) = 5%

PPP : [E(S) – S]/S = [E(id) – E(if)]/[1+E(if)]

[E(S)-$1.13]/$1.13 = (0.02 – 0.05)/1.05 = -0.0286

E(S) = -0.0286*$1.13 + $1.13 = $1.10

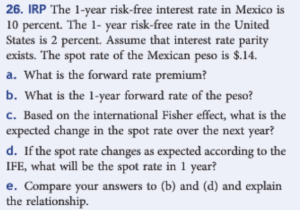

Ans.

IRP exists → (F – S)/S = (id – if)/(1 + if)

a. Forward Rate Premium = (0.02 – 0.1)/1.1 = -0.0727

b. F: 1-year forward rate of peso

(F – $0.14)/$0.14 = -0.0727, F = -0.0727*$0.14 + $0.14 = $0.1298

c. IFE : [E(S) – S]/S = (id – if)/(1 + if)

(id – if)/(1 + if) = (0.02 – 0.1)/(1 + 0.1) = -0.0727 = -7.27%

d. $0.14*[1 + (-0.0727)] = $0.1298

e. 因為利率平價理論成立→遠期利率溢酬與即期匯率預期變化百分比相同

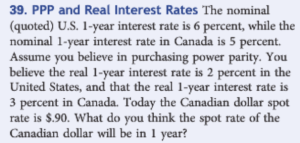

Ans.

PPP exists : [E(S) – S]/S = [E(Id) – E(If)]/(1 + E(If))

US : nominal interest rate = 6%, real interest rate = 2%

CA : nominal inetrest rate = 5%, real interest rate = 3%, CAD spot rate = $.90

Expected inflation in the US = 6% – 2%=4%

Expected inflation in CA = 5% – 3% =2%

Expected percentage change in CAD = [(1 + 0.04)]/[(1 + 0.02)] – 1 = 0.0196 = 1.96%

The spot rate of the CAD in one year = $0.90*(1 + 0.0196) = $0.9176

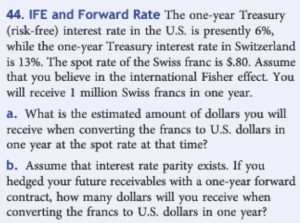

Ans.

1,000,000F

US : interest rate = 6%

CH : interest rate = 13%, spot rate = $.80

a. spot rate in one year = $.80*1.13 = $.904

The estimated amount of dollars = 1,000,000 * $0.904 = $904,000

b. IRP hold→(F – S)/S = (id – if)/(1 + if)

(F – $0.8)/$0.8 = (0.06 – 0.13)/(1 +0.13) = -0.0619

F = (-0.0619*$0.8) + $0.8 = $0.7505→1,000,000*$0.7505 = $750,500

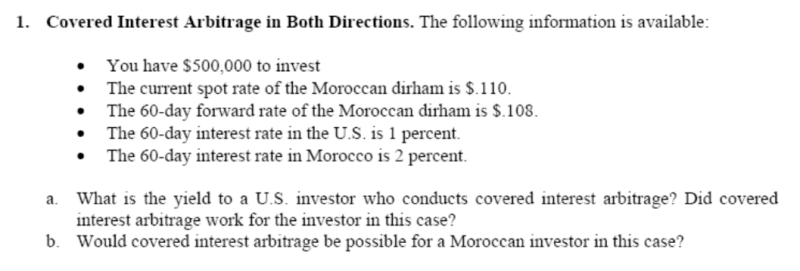

Ans.

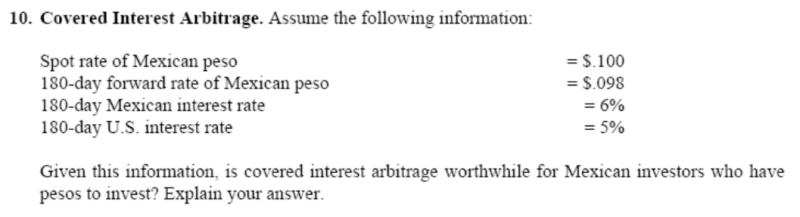

Ans.

Ans.

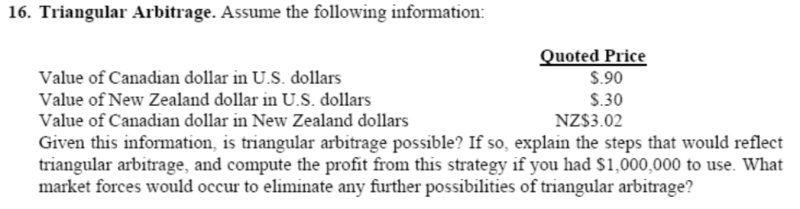

Ans.

2. 國際金融市場筆記

IFM_HW6Foreign Exchange Market

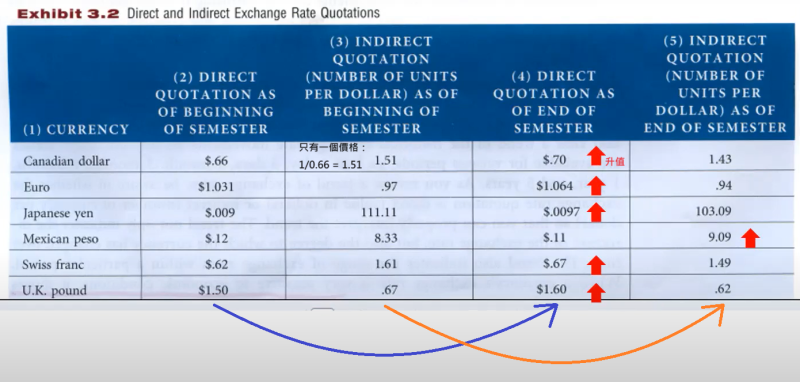

直接vs間接報價

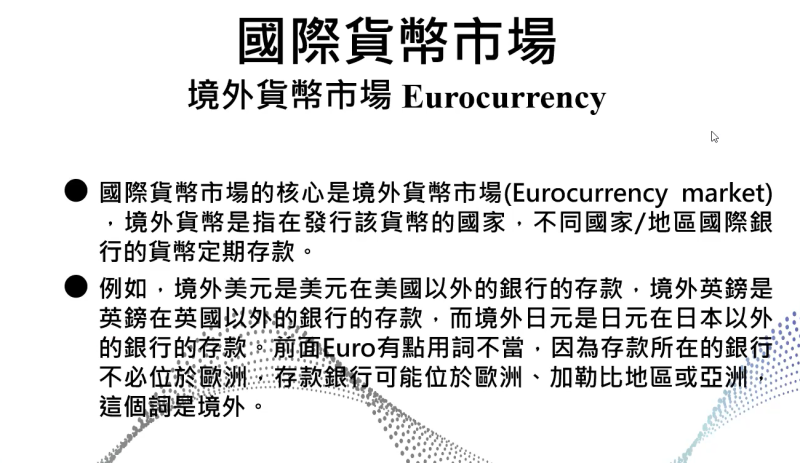

International Money Market(舊教材在筆記中,以下為新教材)

緣起

銀行系統

- 外部銀行系統:與發行國家國內銀行系統平行運行

- 兩格銀行系統都從存入的資金中尋找存款並向客戶提供貸款

- 境外銀行不受準備金要求及存款保險約束→營運成本更低,因此發展迅速

境外貨幣交易

境外貨幣金融中心

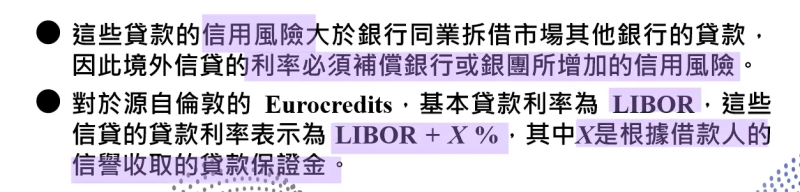

International Credit Market

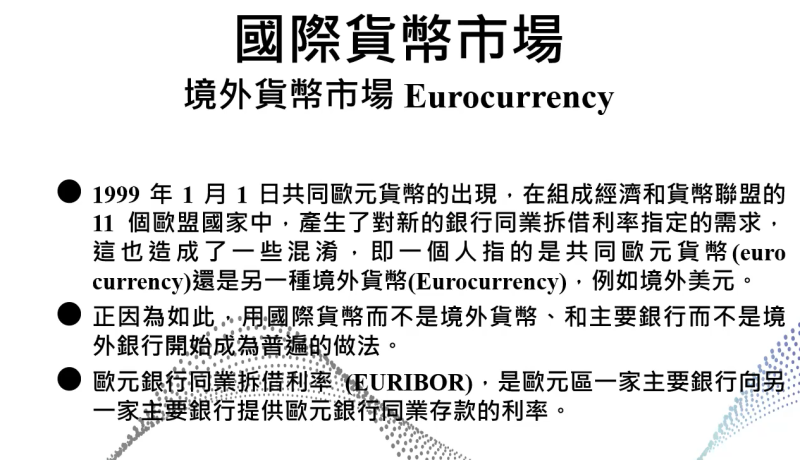

歐元的出現

銀行貸款 – EURIBOR

International Bond Market

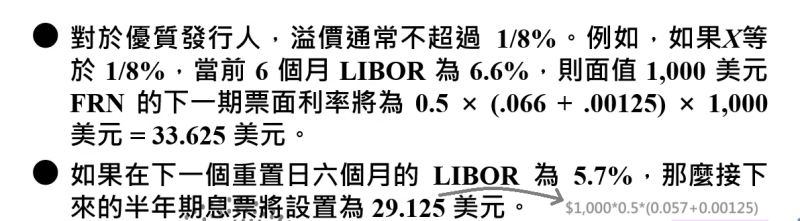

Example of Floating – Rate Notes

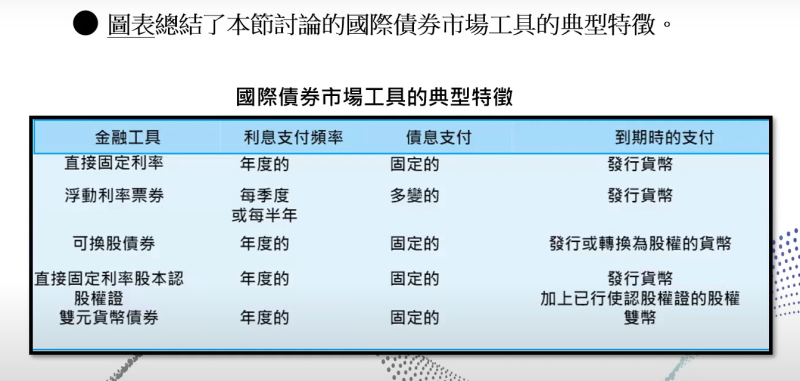

Type of Bonds

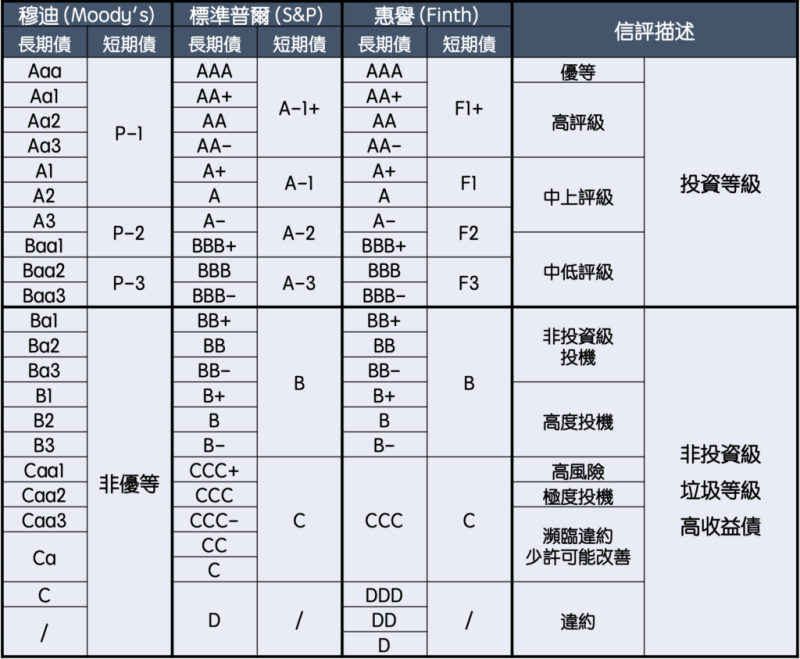

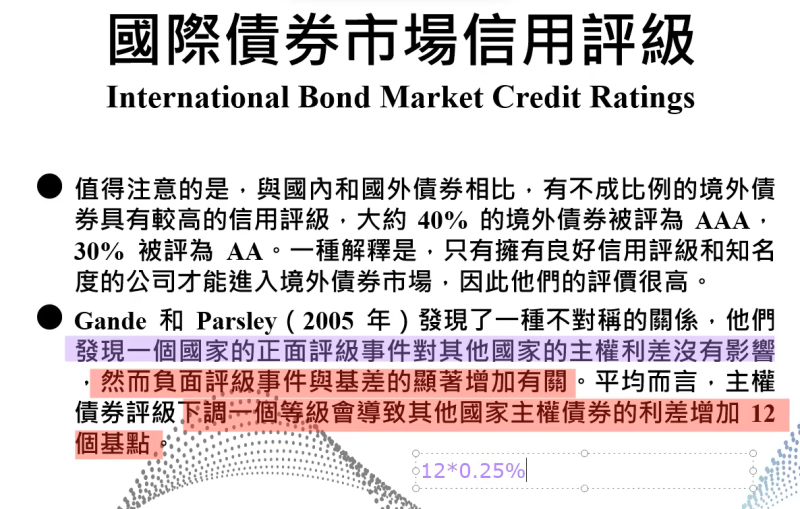

國際債券市場信用評級

※影片錯誤:

國際金融市場課程影片中,57:20-1:03:30視窗分享錯誤