WEEK 11

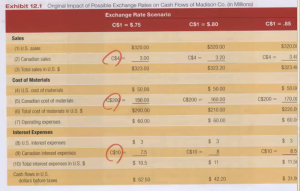

1. 以下圖例,若預期未來加拿大幣升值,則下列何者行為可以避險?

A. 減少在加拿大的營收

B. 減少在美國國內的生產改由加拿大生產

C. 減少加拿大的成本、增加美國成本

D. 減少在美國借錢、增加在加拿大借錢

2. 經濟風險管理的目標就是在面臨匯率變動時維持企業的____穩定。

A. 資產

B. 帳面價值

C. 獲利

D. 財富

3. MNCs may restructure their operations to reduce their economic exposure by__________ to other locations in other to match cash inflows and outflows in foreign currencies.

A. changing the company address

B. shifting the sources of costs or revenue

C. changing the suppliers

D. none of the above

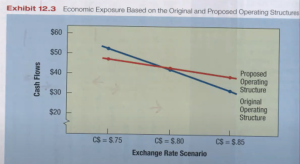

4. 關於下圖例,以下何者錯誤?

A. 原始的線標準差較小

B. 經調整後,標準差會變小

C. 線越陡,標準差越大

D. 原始的線隨著外幣升貶值,現金損益會有較大的波動

5. Central Bank quotes the following for the British pound and the China CNY:

Quoted Bid Price Quoted Ask price

Value of a British Pound in NTD 50.33 NTD 50.66 NTD

Value of a China CNY in NTD 4.963 NTD 5.125 NTD

Value of a British Pound in China CNY 9.7195 CNY 9.75 CNY

Assume you have NTD 10,000 to conduct triangular arbitrage. What is your profit from implementing this strategy?

四捨五入到小數點第一位

A. 138.5

B. 238.3

C. 38.3

D. 138.3

6. Assuming no transaction costs and a quoted cross-rate of AUD/CAD=1.0101. If CAD/USD=0.72881 and USD/AUD=1.3904, the profit margin under the triangular arbitrage opportunity is_____.

A. 0.02357 USD

B. 0.73617 AUD

C. 0.02337 USD

D. 0.20775 USD

7. Transaction exposure __________.

A. reduces exposure to price or rate fluctuations

B. include financial assets that represent a claim on other assets

C. is exposure to brokerage fees and commissions when buying hedging instruments

D. is short-run financial exposure due to uncertain prices or interest rates

8. A short-term financial decision based on an MNC management’s expectation that the local foreign currency will appreciate may be:

A. increasing local customers accounts receivable and increasing local notes payable

B. decreasing local notes receivable and decreasing accruals

C. increasing local inventories and increasing local notes payable

D. increasing local accounts receivable and decreasing local accounts payable.

9. Assume the bid rate of a New Zealand dollar is $0.33 while the ask rate is $0.335 at Bank X. Assume the bid rate of the New Zealand dollar is $0.32 while the ask rate is $0.325 at Bank Y. Given this information, what would be your gain if you use $1,000,000 and execute location arbitrage?

A. $15,385

B. $15,625

C. $22,136

D. $31,250

10. Determine whether arbitrage opportunities exist given the following foreign exchange rates:

A. $1.8/L、DM2/$、DM4/L

B. ¥ 100/$、DM2/$、¥ 50/DM

C. HKD 7.8/$、¥100/$、¥ 14/HKD

D. Both A and C

WEEK 12

1. 關於”預測”的敘述,下列何者正確

A. 一般金融資產價格的預測,都是指報酬率的預測,先預測報酬率,然後再乘上價格,得到價格的預測。

B. 在橫斷面迴歸,傾向用 predict

C. 在縱斷面迴歸,傾向用 forecast

D. 以上皆是

2. 弱式效率市場假說

A. 駁斥技術分析,但基本分析仍然有效。

B. 駁斥基本分析,但技術分析仍然有效。

C. 同時駁斥基本分析與技術分析。

D. 駁斥技術分析,但對於基本分析有效與否,仍要看半強式效率市場是否成立。

3. Which one of the following statements is not correct?

A. The semi-strong form of the EMH states that all publicly available information must be reflected in the current stock price.

B. The strong form of the EMH states that all information including inside information must be reflected in the current stock price.

C. Proponents of the EMH typically advocate a passive investment strategy.

D. Random price movements of stock price indicate irrational markets.

4. A class of Efficient Market Hypothesis that implies all public information is calculated into a stock’s current share price. This is

A. weak form efficiency.

B. semi-strong form efficiency.

C. strong form efficiency.

D. super form efficiency.

5. The main difference between the three forms of market efficiency is that

A. the definition of efficiency differs.

B. the definition of excess return differs.

C. the definition of prices differs.

D. the definition of information differs.

6. 下列關於自我相關模型之敘述何者有誤?

A. AR(1)誤差模型指的是每一期的誤差項含有落後一期誤差項的影響成分,再加上當期發生的隨機干擾項

B. 自我迴歸模型指的是,時間序列變數以自己的落後期作為解釋變數的迴歸模型

C. 時間序列之定態條件不成立,模型依然可以良好運作

D. 以AR(1)模型估計匯率資料指的是,以自己前一期匯率資料作為解釋變數來預測下一期

7. 下列關於模型預測能力的比較,何者有誤?

A. 將資料分為訓練期和驗證期兩部分

B. 用驗證期的資料來建立模型

C. 看驗證期的實際值與模型預測值,進行各個模型絕對差的比較選擇最準的模型

D. 以上皆非

8. 關於迴歸統計中”R 平方”之敘述下列何者有誤?

A. 其代表所有解釋變數X 用線性迴歸模型所能解釋的應變數Y

B. R 平方介於正負一之間

C. R 平方越大,解釋力越強

D. 以上皆正確無誤

9. 關於迴歸統計中的判定係數和F值之敘述下列何者有誤?

A. R square 和 F值,有可能出現一個大一個小的形況

B. 兩者皆可用來判斷迴歸模型是否具有解釋力

C. 計算F值之完整步驟,需要有其自由度、總平方和SSTO及迴歸平方和或誤差平方和

D. 以上皆正確無誤

10. 關於強式效率市場之敘述何者正確?

A. 可透過基本分析來獲取超額報酬

B. 無法透過內線資訊來獲取超額報酬

C. 半強式效率市場必滿足強式效率市場

D. 其代表市場已反應所有歷史公開資訊